Our portfolio is constructed to generate alpha returns through select investments in lower mid-market industries where demand for capital, products and services is great, yet supply is constrained.

Our thematic approach is designed to deliver consistency across market cycles. As demographics, markets and technologies change our strategy adapts by opportunistically emphasizing industries with sustainable growth. Value is realized by proactive investing, not financial engineering. We rigorously evaluate investments leveraging our proprietary due diligence process and partner with organizations where growth is a byproduct of operational improvement, add-on acquisitions and client accrual.

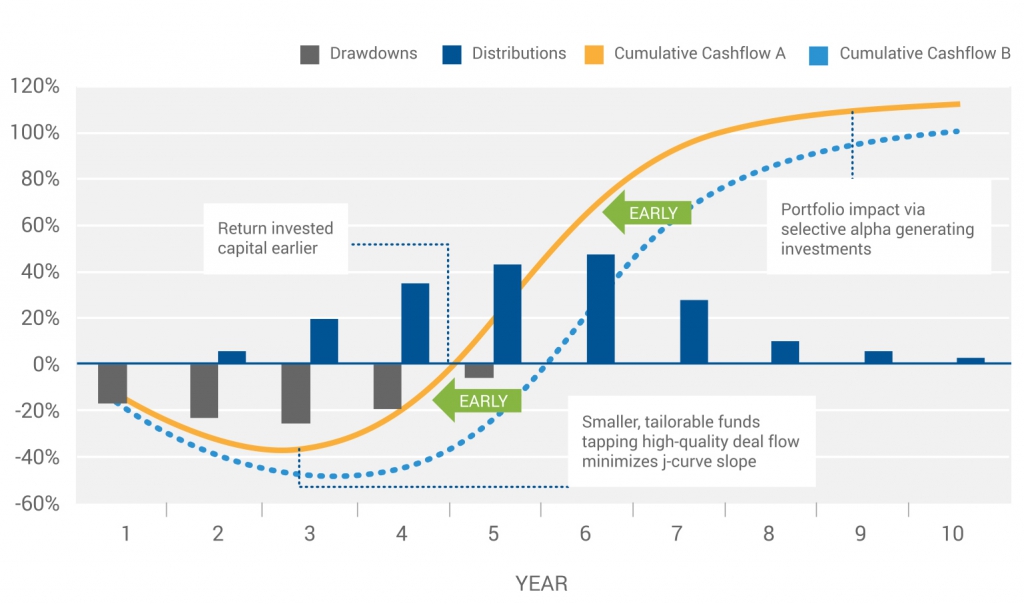

J-curve mitigation with an earlier return on invested capital is consequential to portfolio impact. By constructing smaller and more nimble funds that have access to tremendous, high-quality deal flow, we can more promptly put capital to work. WP Global Partners tailors the funds on a per client basis, which provides fee flexibility that can reduce the initial slope of the J-curve.

Investment Focus

Company Revenue

$25-250M

EBITDA

$0-25M

Investment Amount

$5-25M

Stake

Minority & Majority

Operating Profile: We seek investments that have the following thematic characteristics:

- Recurring or backlogged revenue

- Entrenched customer base

- Clear opportunities to streamline operations or grow sales operations

- Well-aligned management seeking roll-over equity

- Fragmented markets with add-on acquisition potential

- Demand for products and services is great, yet supply is constrained